Unveiling the Financial Metrics: A Comprehensive Guide on How to Calculate the Net Asset Value (NAV)

Introduction:

The Net Asset Value (NAV) is a fundamental financial metric that holds paramount importance in the realms of investment management, mutual funds, and financial analysis. It serves as a critical indicator of the value of an investment fund’s assets per share, providing investors with insights into the fund’s performance and overall health. In this extensive guide, we will delve into the intricacies of the Net Asset Value, exploring its definition, significance, and step-by-step procedures on how to calculate it, shedding light on the mechanisms that underpin this crucial financial metric.

Section 1: Unpacking the Net Asset Value (NAV)

1.1 Definition of NAV:

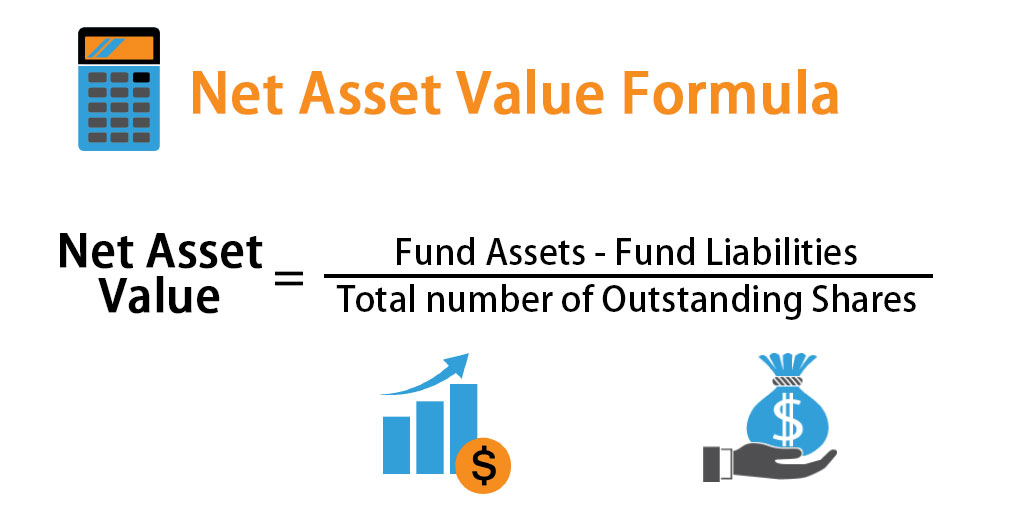

- The Net Asset Value represents the per-share market value of a mutual fund or investment company’s assets. It is a measure of the fund’s intrinsic value, calculated by subtracting its liabilities from its total assets and then dividing the result by the number of outstanding shares.

1.2 Significance of NAV:

- NAV is a pivotal metric for both investors and fund managers. It provides a transparent view of the fund’s value, allowing investors to assess the performance of their investments. Fund managers utilize NAV to determine the pricing of shares, facilitate transactions, and ensure fair and accurate valuations.

Section 2: Components of Net Asset Value

2.1 Assets:

- The assets component of NAV encompasses all the investments held by the fund. This includes stocks, bonds, cash, and other securities. Accurate valuation of these assets is crucial for determining the fund’s true worth.

2.2 Liabilities:

- Liabilities consist of any outstanding debts or obligations the fund may have. This can include operational expenses, fees, and any other financial commitments. Subtracting liabilities from assets yields the fund’s net value.

Section 3: Calculating Net Asset Value (NAV) Step by Step

3.1 Identifying Assets:

- Begin by compiling a comprehensive list of the fund’s assets. This entails valuing each investment, taking into account market prices, interest rates, and other relevant factors.

3.2 Determining Liabilities:

- Next, identify and quantify all liabilities associated with the fund. This may include management fees, operational costs, and any outstanding expenses. Subtract these liabilities from the total assets.

3.3 Calculating Net Asset Value (NAV):

- The formula for calculating NAV is straightforward:

\text{NAV} = \frac{\text{Total Assets} – \text{Total Liabilities}}{\text{Number of Outstanding Shares}}

- This formula yields the per-share value of the fund.

Section 4: The Role of Outstanding Shares

4.1 Understanding Outstanding Shares:

- Outstanding shares represent the total number of shares held by investors. Including this variable in the NAV calculation ensures that the metric reflects the per-share value, allowing investors to understand the fund’s worth on a per-unit basis.

4.2 Dynamic Nature of Outstanding Shares:

- The number of outstanding shares is subject to change based on factors such as new investments, redemptions, or share buybacks. Fund managers must regularly update this variable to maintain accurate NAV calculations.

Section 5: Importance of Accurate Valuation

5.1 Market Prices and Fair Valuation:

- Accurate valuation of assets is crucial for providing investors with a fair representation of the fund’s value. Market prices, interest rates, and other valuation methods must be employed to ensure that assets are valued at their current market worth.

5.2 Impact on Investor Decisions:

- Investors rely on NAV to make informed decisions regarding their investments. An accurate NAV calculation reflects the true value of the fund, allowing investors to assess performance, track returns, and make strategic investment choices.

Section 6: NAV in Mutual Funds

6.1 Redemption and Purchase Transactions:

- In mutual funds, NAV plays a pivotal role in facilitating transactions. Investors can buy or redeem shares at the NAV price, ensuring a fair and transparent process.

6.2 Daily Calculation:

- Mutual funds typically calculate NAV on a daily basis. This daily valuation ensures that investors receive real-time information about the fund’s value, allowing for timely decision-making.

Section 7: Challenges and Considerations in NAV Calculation

7.1 Illiquid Assets:

- Valuing illiquid assets can pose challenges in NAV calculation. Fund managers must employ accurate methods to assess the fair value of such assets, considering market conditions and other relevant factors.

7.2 Fair Value Accounting:

- Fair value accounting principles guide the valuation process. However, determining fair value, especially in volatile markets, requires diligence and a keen understanding of market dynamics.

Section 8: Utilizing NAV for Investment Decision-Making

8.1 Performance Assessment:

- Investors use NAV to assess the historical performance of a fund. Tracking changes in NAV over time provides insights into the fund’s growth, stability, and overall investment performance.

8.2 Comparative Analysis:

- NAV enables investors to compare the performance of different funds. By evaluating the NAV of various funds within the same category, investors can make informed decisions based on their financial goals and risk tolerance.

Section 9: Conclusion – Navigating Financial Waters with NAV Mastery

Mastering the calculation and interpretation of Net Asset Value is an indispensable skill for investors, fund managers, and financial analysts alike. By unraveling the components, understanding the significance, and following the step-by-step calculations, stakeholders can harness the power of NAV to make informed investment decisions. Whether navigating mutual funds, assessing the performance of investment portfolios, or ensuring fair and transparent transactions, the mastery of NAV opens doors to a deeper understanding of financial markets and empowers individuals to navigate the complex waters of investment with confidence.